- #Nc real estate license renewal deadline license

- #Nc real estate license renewal deadline professional

#Nc real estate license renewal deadline license

Have you ever had a real estate license revoked or cancelled in this state or another state?.

#Nc real estate license renewal deadline professional

You will also be asked a series of questions about your personal and professional background as part of the application. Mailing address and contact information.To complete the application, you will need to provide: Both are equivalent terms for the entry-level license in real estate. If you live in a Broker-only state, look for the Provisional Broker application. If your state offers a real estate sales agent or salesperson license, this is the application that you will complete for your new license. All states offer an online application portal, while only a few have a paper copy of their application available. Most people choose to take their pre-license education courses online through an accredited real estate education company.Īs you near completion of your pre-licensing education, you will be ready to work on your real estate license application paperwork. You can take classes through any accredited institution, including state universities, community colleges, or real estate licensing programs approved by your state’s regulatory authority. You should plan to take four to six months to complete your pre-licensing education requirements. It is crucial to check your state’s requirements before enrolling in classes to make sure that the state Real Estate Commission will accept them as your pre-licensing requirement. The required hours range from 63 to 180 documented hours from an approved program. Most states require a class on the Principles of Real Estate and a practical course, such as Real Estate Practice. These can include classes on property management, general accounting, business law, or real estate office administration.

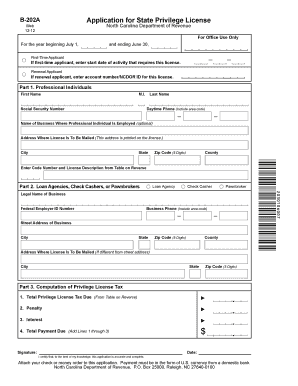

Some states allow for customized study plans by counting Real Estate Elective courses toward the real estate pre-licensing requirements. Real Estate Practice (45 hours): Most states require this or a similar course.Principles of Real Estate (45-60 hours): This course is required in most states.You can expect something similar to the course load below. The topics and required hours vary by state. Submit the form along with payment to the Department through the mail or by dropping it off at one of the service centers.Most states require pre-licensing education in order to become a real estate agent. If you did not receive your renewal form, you can fill out the B-202A and mark the renewal circle as well as fill out your account number and information. The failure to file to obtain a license penalty is 5% of tax due for each month, or part of a month, the return is late.The failure to pay penalty is 10% of the amount due.If you can’t pay by the due date, you may be assessed penalties and interest. Return to top What if I need to change my name or address?Ĭomplete a Business Address Correction Form (Form NC-AC.)ĭo not mark the changes on the return as they cannot be read by our scanners. You must notify us or you will be assessed for the unpaid tax due. Return to top Where can I get more information?įill-in the out-of-business date shown in the middle of the detachable return, or complete the Out-of-Business Notification (Form NC-BN.) Review the Privilege License Tax Information page, and the included NC General Statutes, to see if you need a privilege license. To learn more about the privilege license process, watch this privilege license video.

The privilege tax cannot be paid online or over the phone.The tax for a principal or manager is $50, and the tax for each assistant is $12.50. You must send one return for the principle or manager for the accountant, and a separate return for all assistant accountants combined. What should I do if I am still in business and did not receive my renewal form?Ĭomplete the detachable return at the bottom of the notice, and mail it along with payment to the Department by July 1. What if I need to change my name or address? Where can I get more information? Common Questions This notice is sent as a reminder that your annual state privilege tax for the upcoming fiscal year is due.

0 kommentar(er)

0 kommentar(er)